What is a Medicare Supplement?

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare.

When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then, your Medicare Supplement plan starts to help with covering costs up to the plans limit. That limit usually covers what Medicare didn't, however, that will depend on which policy you select.

What do Medicare Supplements cover?

Original Medicare only covers 80% of your Part B expenses. The other 20% comes out of your pocket if you do not have a Medicare Supplement policy also referred to as Medigap. If you were to have a lengthy stay in a hospital or expensive treatments at outpatient facilities, you can see how that could add up.

Medicare Supplements pay that 20% for you.

Is there anything not covered by Medicare Supplement Plans?

Things that are not covered by Original Medicare on your Medicare Supplement:

- Routine dental, vision, and hearing exams

- Hearing aids

- Eyeglasses or contacts

- Long-term care or custodial care

- Retail prescription drugs

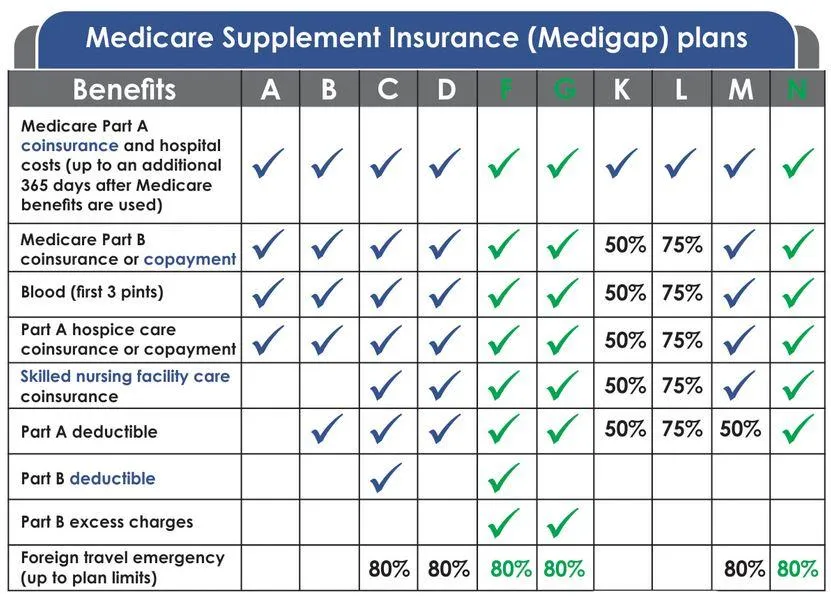

Which Medigap Plans Can I Choose From?

Plans that are highlighted in green above are the 3 most popular plans that clients choose when selecting a Medigap/Medicare Supplement plan.

Get a Consultation

& Quote at No Cost

Safeguard Financial Group INC Copyright

2025 -- All Rights Reserved --

Phone: (440) 574-3087 Email: [email protected]

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800 MEDICARE to get information on all of your options.